DFAT has a portfolio of blended finance mechanisms that mobilise private finance for development outcomes. Recognising the effectiveness of this approach, the Government endorsed the August 2023 Development Finance Review's recommendations to scale up Australia's blended finance portfolio to drive greater development, climate, and gender equality outcomes in the region.

2 What is Blended Finance?

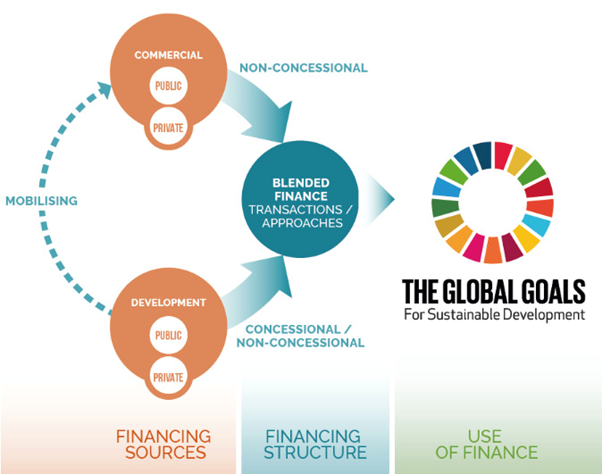

Blended finance is the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development (Convergence, 2023). DFAT’s blended finance portfolio is designed to draw in private sector investment to support Australia's development goals in our region, at a larger scale than traditional grant aid. DFAT’s investments are impact first – focussed on projects or investments that help achieve the Sustainable Development Goals.

Private capital is often reluctant to invest in emerging economies due to higher real or perceived risks. By providing concessional capital, DFAT’s blended finance portfolio makes projects or investments that have strong development impacts more attractive for private capital to co-invest in. This allows different sources of capital with different risk and financial return objectives to participate in the same investment.

The blended finance global network (Convergence) calculates that blended finance deals have mobilised approximately USD $231 billion in global capital towards sustainable development between 2014 and 2024.

3 What is Australia investing in?

DFAT’s impact investment portfolio currently supports investments across South and Southeast Asia, and the Pacific, with the largest volume of investment in Southeast Asia.

DFAT’s investments are impact first – focussed on projects or investments that help achieve the Sustainable Development Goals. These investments prioritise climate change and women’s economic empowerment outcomes.

The Australian Government invests in a variety of sectors including but not limited to, green field and early-stage infrastructure development, energy, agriculture, water, health, small and medium enterprise finance, and projects that support financial market innovation in the region.

DFAT’s blended finance investments must demonstrate additionality. Investments are expected to catalyse additional private sector investment and development outcomes that would not have been realised without DFAT’s involvement.

4 The Australian Development Program's Blended Finance Portfolio

DFAT’s blended finance portfolio is comprised of mechanisms that make financial investments, as well as supporting initiatives that can deploy grants and/or provide support to partnerships to develop a pipeline of investible deals. In some instances, multiple components of DFAT’s portfolio are active in the development and subsequent investment in deals.

5 Australian Development Investments (ADI)

Australian Development Investments (ADI) is Australia's AUD $250 million impact investment fund. ADI provides early stage and concessional investment to impact investment funds. These funds in turn give critical early-stage finance to small and medium businesses that are driving climate action and gender equality in the Indo-Pacific.

ADI uses a blended finance approach. It utilises concessional finance to de-risk transactions and attract additional private finance into deals with sustainable development outcomes, helping to bridge the climate and development finance gap across the Indo-Pacific. ADI also provides technical assistance alongside its investment to ensure rigorous impact measurement, promote gender equality, and enhance project bankability.

Affordable finance is essential for businesses to innovate, grow their employment, and deliver goods and services to their communities. ADI supports sustainable development in the region by expanding the finance options available to businesses through the impact investment market. By blending Official Development Assistance and private finance, ADI sends a powerful signal to the finance sector about the opportunities to generate financial returns and development impact in the region.

Since 2020, the ADI portfolio has achieved the following impacts:

- Creating over 9,800 jobs, half of which are held by women;

- Financing over one million female microenterpreneurs; and

- Mobilising over 160 million in private investment, with a mobilisation rate of 1:6 (one dollar of ADI capital leverages six dollars in private sector investment).

For more information, visit the website: Australian Developments Investments (ADI) or read the fact sheet:

6 Private Infrastructure Development Group (PIDG)

The Private Infrastructure Development Group (PIDG) is a multilaterally funded infrastructure project developer and investor. PIDG operates across the entire infrastructure project lifecycle to develop sustainable and inclusive infrastructure. PIDG uses public finance to develop or assist early-stage projects to overcome any financial, technical or safeguards challenges to become investment ready, bankable projects. Australia's contributions to PIDG are helping to drive its expansion into South and Southeast Asia. The core focus of PIDG infrastructure projects in the Indo-Pacific region is increased access to stable renewable energy sources, clean drinking water and agribusiness logistics facilities.

The PIDG uses a large range of financing solutions including equity, debt, guarantees, and technical assistance to enable projects to attract commercial financing. Australia's co-ownership and financing of PIDG supports two of the PIDG group companies operating in our region: InfraCo Asia and GuarantCo.

Australia’s investments since 2012 have delivered 126.1MW of clean and sustainable energy capacity and helped over 178,000 people gain access to clean energy.

7 Australian Climate Finance Partnership (ACFP)

The Australian Climate Finance Partnership (ACFP) is Australia's up to AUD 140 million concessional financing facility designed to mobilise private sector investment in low emission, climate-resilient solutions for the Pacific and Southeast Asia. It is a 10-year initiative managed by the Asian Development Bank (ADB).

Projects are supported to reduce climate emissions, increase a partner country’s resilience, empower women, and improve the investment environment for additional private climate finance. The ACFP responds to market gaps and demand by de-risking and bringing to market demonstration projects with strong impact. Financing is provided for non-sovereign climate projects at different stages of development to crowd-in private sector finance. This process maximises impact by following blended finance principles that ensure that projects receive only the minimum amount of support required to succeed.

8 Convergence

Convergence is the pre-eminent global network for blended finance – managing the world's most comprehensive database of blended finance transactions. This includes historical data, as well as current and prospective deals. It also hosts the largest blended finance match making platform – connecting project proponents with potential financiers both public and private.

Australia's partnership with Convergence provides DFAT and its partners (including other government partners and private financiers) with access to Convergence's databases, technical support, and training capabilities. This partnership continues to play a significant role in supporting Australia's capacity to scale its blended finance response to climate and development needs in the region.

DFAT supports two competitive design funding grants through Convergence - the Asia Climate Solutions grant and the Catalytic Climate Finance Facility. The design funding programs provide support for proponents to develop and launch early-stage blended finance structures that aim to attract private capital.

9 Business Partnerships Platform (BPP)

The Business Partnerships Platform (BPP) supports direct partnerships between the Australian Government and inclusive and sustainable businesses to advance Australian priorities and deliver development and climate impacts.

BPP partnerships bring together businesses, NGOs and academic institutions to target a diverse range of objectives driven by country and thematic priorities. The unique partnership model incorporates a sharing of networks, reputation, knowledge and expertise that has enabled a wide variety of partners to collaborate. These partnerships have successfully piloted experimental business models that combine impact with sustainable commercial returns.

The BPP is in its second phase, having supported an initial series of partnerships from 2015-2020. The 35 partnerships in the first phase catalysed $28.9 million in co-contributions, nearly double Australia’s investment of $14.8 million. The current phase consists of 47 partnerships supported by Australia’s investment of a further $18.7 million.

The BPP is the key mechanism under the broader Impact Private Sector Partnerships Program (IPSP). An independent evaluation of IPSP was completed in July 2025.

10 Engage with DFAT’s Investment Portfolio

Southeast Asia presents a lucrative opportunity for Australian investors, as acknowledged by Invested: Australia’s Southeast Asia Economic Strategy to 2040. The region is an economic powerhouse fuelled by favourable demographics, industrialisation, urbanisation and technological advances. Southeast Asia (as a bloc) is projected to become the world's fourth-largest economy by 2040, after the United States, China and India, with an expected compound annual growth rate of 4 per cent between 2022 and 2040.

Opportunities in Southeast Asia extend beyond traditional investment targets, as the impact investment market continues to strengthen and provide investment opportunities that align with improved climate and gender outcomes. Economic investment in decent jobs, inclusive products and services, and the clean energy transition are critical to the region’s future.

DFAT appreciates the pivotal role that philanthropies, impact investors and institutional investors play in scaling investment. DFAT is working collaboratively with a group of Australian family offices and foundations through the International Development Investor Group (IDIG) to attract more Australian impact investment into the region. DFAT supports regional exposure and deal origination, by sharing impact investment opportunities, due diligence, and market intelligence.

Jennifer Buckley, managing director of SWEEF Capital, said DFAT’s involvement “has been instrumental in deepening SWEEF’s relationships with institutional partners and family offices, including from Australia, Canada and Europe”.

– James Eyers, Australian Financial Review, 14 November 2022

If you are looking for impact investment opportunities in emerging markets in South Asia, Southeast Asia or the Pacific Islands, please reach out to us via email at blended.finance@dfat.gov.au.

11 Portfolio Performance Management

The Blended Finance Learning Program (BFLP) is a central part of DFAT's blended finance performance management framework – helping us to maintain oversight and monitoring of the blended finance portfolio, provide greater transparency and support program financing designs.

Read the report: Review of DFAT Australia’s Blended Finance Investments, 2022 [PDF 2.1 MB].