Summary Report

Section 1: Background

1. In June 2006, the government of the United Arab Emirates

(UAE) informed the Australian Government that in response to the

decision by the Supreme Council of the Gulf Cooperation Council

(GCC), member countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia

and the UAE) could only negotiate free trade agreements (FTA)

collectively, with the exception of the United States (US). The UAE

proposed that its bilateral FTA negotiations with Australia be

incorporated into GCC-wide negotiations.

2. The Department of Foreign Affairs and Trade (DFAT) then

undertook an analysis of the economic and trade implications of an

FTA with the GCC as a whole.

Section 2: Overview of the trade and investment relationship

3. Australia has substantial merchandise export interests to protect and expand in the GCC. In 2005-06, the GCC took over $A4.8 billion of Australian merchandise exports, 3.2 per cent of our global total. By value, the GCC ranked as our ninth largest merchandise export market, ahead of Thailand (10th), Singapore (11th), Indonesia (12th), and Malaysia (15th). The GCC took nearly nine per cent of our exports of elaborately transformed manufactures (ETM) making it our third largest market for ETM.

4. Australia's presence in the GCC is expanding rapidly: in the UAE alone, the number of resident Australian companies jumped threefold from around 100 in early 2005 to over 300 by mid-2006, and the number of Australian nationals more than doubled from 6,000 in 2004 to 13,000 in 2006.

Section 3: Changes in the trade policy landscape

5. Economic integration among the GCC member states has advanced. A common external tariff of 5 per cent has been in force since January 2003 (the basis of the GCC Customs Union). The GCC plans to establish a common market by the end of 2007 and monetary union in 2010.

6. The GCC is currently negotiating FTAs with many countries, including the European Union (EU), China, Japan, New Zealand, Singapore, and India. In addition, the US is working towards the completion of a Middle East free trade area, concluding bilateral FTAs with Oman and Bahrain, and working on agreements with other countries in the region.

7. Taken together, these developments raise the prospect of Australian exporters and investors facing relatively higher market access barriers and less favourable business conditions than some of their principal competitors. Unless action is taken, these developments could affect adversely Australian exporters' capacity to maintain market share.

Section 4: Australia's export interests

8. Australia has substantial export interests in the GCC in manufactures, agricultural products and metals.

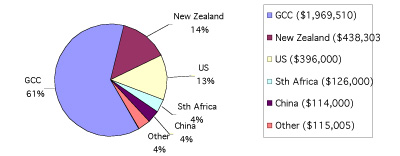

9. The GCC market for Australian passenger motor vehicles (PMV) has grown rapidly over the past decade. It is now our largest market for PMV: in 2005-6, it took 61 per cent of our total exports by value ($A1.9 billion). Within the GCC, Saudi Arabia is Australia's largest PMV market, valued at $A1.2 billion in 2005-06.

Figure 1: Australia's PMV exports to the world, 2005-06 ($A000's)

Source: DFAT STARS database

10. Australia's mineral exports to the GCC are dominated by alumina. Trade was estimated at over $A1 billion in 2005-06. Twenty eight per cent of Western Australia's alumina exports go to two GCC members, Bahrain and the UAE.

11. The GCC is an important market for Australian meat and livestock exports. In 2005-06, it took 33 per cent of our total live animal exports and around nine per cent of our non-bovine meat exports. Including bovine meat exports, the sector generated combined export earnings of about $A501 million.

12. In 2004, the GCC took 46 per cent of our total barley exports with a value of nearly $A600 million. In 2005-2006, it took at least 28 per cent of Australia's total barley exports, valued at $A166 million. We are also a major supplier of wheat to the region.

13. In 2005-06, the GCC took 20 per cent of our total cheese and curd exports, valued at $A170 million and five per cent of our total milk and cream exports, valued at $A78 million.

Section 5: Issues on the FTA agenda

Trade in goods

14. As noted above, the GCC applies a common external tariff of 5 per cent on virtually all imports from outside the GCC, including those of high commercial significance to Australia. Higher tariffs apply to some specific products in certain GCC member countries, for example on dairy products and wheat in Saudi Arabia. Some agricultural and mining products sourced from Australia currently benefit from temporary duty waivers in some GCC member countries, but these waivers are not legally secure and can be reversed by the relevant government without penalty. Australian companies have identified a diverse range of potential opportunities in the GCC which are constrained by tariffs. Australia's capacity to protect its current presence in the market, and to expand its exports in the future, are at risk because of the prospect of the GCC entering into preferential trade agreements with other trading partners.

15. In addition to tariffs, Australian businesses have registered concerns about other barriers to trade in goods, including import licensing arrangements, onerous or arbitrary food regulations and labelling requirements, legalisation of documents and discriminatory or non-transparent industrial standards.

16. The GCC is likely to have relatively narrow interests in securing tariff-free access to the Australian market, specifically in aluminium and petrochemical products.

17. Australia would benefit substantially from an FTA that eliminated tariff and other barriers to trade in goods. Australian access would also be enhanced by the inclusion in an FTA of provisions on customs procedures, technical barriers to trade, non-tariff measures, sanitary and phytosanitary measures (SPS) and a wide range of trade facilitation measures. Appropriate rules of origin would be necessary to prevent the circumvention by goods from third countries. An FTA with these provisions would increase export opportunities which in turn would increase Australia's economic growth, trade, investment and employment.

Services

18. Services are becoming increasingly important in trade and investment worldwide both directly as a prominent component of trade, and indirectly by facilitating international business through travel, professional services of various kinds, and especially commercial presence.

19. The services sector accounts for more than 70 per cent of Australia's GDP, and the share of services in the GCC economy is growing rapidly. It is, therefore, likely that the role of services in the overall economic relationship will become much more important.

20. An FTA can play a significant role by generating the liberalisation of services trade, business mobility and the recognition of professional qualifications. Cross border delivery of services can be strengthened; consumption of services abroad can be boosted (for example, when joint research and joint education programs encourage more Australian and GCC students to work and study in each other's country); establishing a commercial presence can be simplified (for example, when Australian financial service institutions can set up in the GCC to provide financial services to GCC citizens); and services delivered through the presence of natural persons can be streamlined through faster recognition of academic and professional qualifications (as when engineers and lawyers can work more readily in each other's country). The GCC has also registered interest in increased access to the aviation services sector.

21. If such outcomes are achieved in an FTA, they would create new opportunities for Australian services exporters, increase trade in services with the GCC and contribute to stronger economic growth in Australia. Both Australia and the GCC would have much to gain from a comprehensive FTA that makes it easier to do business and provides a long term basis for liberalising services.

Investment

22. Australia has significant investment interests in the GCC. Over 300 Australian companies have a commercial presence in the UAE alone. The current levels of investment appear to be lower than they could be in both directions.

23. All GCC countries impose restrictions on foreign investment. Most apply foreign equity caps, in many cases requiring minority ownership. In addition, most enforce restrictions or exclusions on foreign providers of mining and energy-related services, including upstream and downstream activities. Foreign companies operating in the GCC are required to operate through local service agents and distributors who must be GCC nationals. More generous foreign investment regulations have been introduced in some GCC countries, but the pattern is uneven. Some of the restrictions are based on constitutional or legal provisions and are, therefore, difficult to liberalise.

24. The GCC is interested in securing more favourable arrangements for both foreign direct investment and portfolio investment, and in government-level taxation arrangements to underpin the interests of its investors.

25. Australia has derived significant economic benefit from investment and would benefit from its further growth. Productive GCC investment in Australia would contribute significantly to the development of the Australian economy. The same would apply to Australian investment in the GCC. Outward Australian investment in the GCC would also complement the corporate strategies of Australian companies that are responding to the challenges of globalisation.

26. On this basis, there would appear to be merit in a comprehensive FTA that would liberalise, facilitate and protect investment. Such measures would ensure that both Australia and the GCC were in a position to secure the full benefits of the FTA. Many FTAs have included investor-state dispute resolution provisions.

Intellectual property rights

27. The effective protection of intellectual property is a high priority issue for Australian business. All GCC member countries are members of the World Intellectual Property (WIPO) and have enacted laws and regulations in line with relevant WIPO agreements. They have also conducted public awareness campaigns and tackled IP violations through strengthened enforcement measures. There would be benefits for Australia in including intellectual property rights in an FTA, and specifically to explore the scope for commitments that go beyond existing TRIPS obligations.

Transparency

28. Ensuring transparency of relevant laws and regulations is a basic requirement for the liberalisation and facilitation of trade and investment, and in ensuring predictability in business activities. There would be tangible benefits for Australia in including measures in an FTA that improved transparency of the GCC's legal and regulatory frameworks.

Government procurement

29. High levels of government ownership and control in GCC economies makes government procurement a key issue in any FTA negotiations. None of the GCC member states are members of the WTO Agreement on Government Procurement, and nor is Australia. An FTA with provisions on national treatment, non-discrimination and transparency would have merit for Australian business.

Competition policy

30. Australia attaches importance to competition principles in underpinning the market economy. Cooperation with the GCC in this area could assist in the enforcement of relevant laws and, therefore, promote an improved business environment.

Dispute settlement and institutional provisions

31. A chapter on dispute settlement would provide clear procedures in the event of a dispute. Provisions would also be appropriate to establish mechanisms for implementation and to take forward work on the built-in agenda.

Section 6: Conclusions

32. Australian business has responded effectively to the GCC's rapid economic growth and there is evidence to suggest that Australia is well-positioned to participate in its expanding market. A comprehensive and WTO-consistent FTA would be valuable in this context in helping to address discriminatory treatment and barriers to growth in trade and investment. It would deliver potentially significant benefits to Australia:

·by facilitating closer integration of the Australian and GCC economies, an FTA would deliver economic gains to both countries by increasing opportunities for trade in goods and services as well as for two-way investment;

- an FTA would also promote ongoing economic reform and productivity improvements in the GCC; and,

- an FTA would strengthen political-level relations between Australia and the countries of the GCC.

33. From Australia's perspective, negotiations would need to begin with all products on the table with no a priori exclusions. From Australia's perspective, an FTA must be WTO-consistent and to the maximum extent feasible, seek to be WTO-plus. The negotiations would cover trade in goods, services, investment, customs procedures, rules of origin, non-tariff measures and technical barriers to trade, cooperation on sanitary and phytosanitary issues, trade facilitation, government procurement, intellectual property, transparency, competition policy, and dispute settlement and institutional provisions.

34. Australia recognises that concluding a comprehensive FTA with the GCC could raise some potential challenges. To date, the GCC has not concluded a comprehensive FTA along the lines of Australia's preferred model. Some of the commitments that would be sought by Australia in an FTA could raise sensitivities in some GCC member economies, particularly in the areas of services, investment and government procurement. In addition, the GCC has a relatively specific and narrow range of commercial and policy interests that it would be seeking to advance in the context of a comprehensive FTA. Many of the issues of interest to the GCC are in areas that are traditionally handled separately from FTA negotiations.

35. On balance, however, and given the strong level of interest on the part of the Australian and GCC governments and their private sectors, it should be feasible to negotiate an FTA that is comprehensive and WTO-consistent.

Attachment 1: List of public consultations

Australian public and private sector bodies, peak industry, business organisations and unions consulted included:

- Association of Consulting Engineers Australia (ACEA)

- Australasian Meat Industry Employees Union (AMIEU)

- Australia Arab Chamber of Commerce & Industry (AACCI)

- Australian Barley Board (ABB)

- Australian Business Group Abu Dhabi

- Australian Business in the Gulf (Dubai)

- Australian Chamber of Commerce and Industry (ACCI)

- Australian Council for Education Research (ACER)

- Australian Council for Private Education and Training (ACPET)

- Australian Council of Trade Unions (ACTU)

- Australian Dairy Industry Council Inc.

- Australian Electrical and Electronic Manufacturers' Association (AEEMA)

- Australian Fair Trade and Investment Network (AFTINET)

- Australian Film Commission

- Australian Industry Group

- Australian Meat Industry Council

- Australian Pesticides & Veterinary Medicines Authority (APVMA)

- Australian Seafood Industry Council

- Australian Services Roundtable

- Australian Vice-Chancellors' Committee

- Australian Wheat Board Limited

- Australian Wine and Brandy Corporation

- Copyright Agency Limited

- Council for Australia-Arab Relations (CAAR)

- Council of Textile and Fashion Industries of Australia Limited

- Engineers Australia

- Federal Chamber of Automotive Industries

- Global Trade Support Limited

- Government of Western Australia

- Horticulture Market Access Committee

- Master Builders Australia Inc.

- Meat and Livestock Australia Limited

- Minerals Council of Australia

- National Farmers Federation (NFF)

- National Food Industry Strategy

- National Institute of Accountants (NIA)

- New South Wales Government

- Northern Territory Government

- Plastics and Chemicals Industries Association

- Queensland Government

- Royal Australia Institute of Architects (RAIA)

- Screen Producers Association of Australia

- Sheepmeat Council of Australia

- South Australian Government

- Standards Australia Limited

- Tasmanian Government

- The Media, Entertainment and Arts Alliance

- Victorian Government

- Viscopy Limited

111 individual companies were also consulted.