The key to overseas services provision

Australian companies are increasingly establishing foreign affiliates to deliver services to the world. The trend is particularly strong in the finance and insurance sector, which has invested $71.1 billion in affiliates abroad.

A new study shows that 1,245 foreign affiliates of Australian companies provided financial and insurance services in 2009–10, almost three times the number in 2002–03.

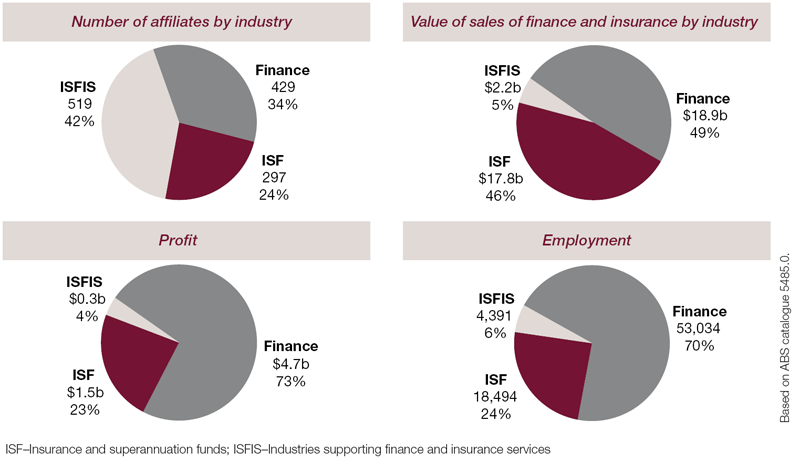

The total value of sales by foreign affiliates was $38.9 billion, with profits of $6.5 billion. These profits directly benefit Australia by contributing to gross national income.

The study shows that international sales of financial and insurance services by Australian companies are overwhelmingly delivered through foreign affiliates, rather than through direct sales from within Australia. This trend underlines for Australian businesses the importance of establishing a physical presence in overseas markets to better take advantage of opportunities abroad.

All amounts are in Australian dollars.

Print version

Australia's Global Services Network [PDF 890 KB]

Australia's foreign affiliate trade

Our official export statistics don't cover all aspects of Australian business overseas. Trade by Australia's foreign affiliates is not included, because it takes place outside Australia.

However, it is important to understand the extent of our foreign affiliates' trade because this business reflects Australia's links with the world economy – particularly – in the financial services trade – and its contribution to gross national income.

New research

To better understand the trade of Australia's foreign affiliates, the Department of Foreign Affairs and Trade commissioned a new survey, Australian Outward Finance and Insurance Foreign Affiliate Trade 2009–10.

The survey was conducted by the ABS and published in June 2011. It examined foreign affiliate business in the finance and insurance industry, where Australian companies had majority, or near-majority, ownership.

The survey was a 'one-off', however some comparisons can be made between this and a 2002–03 survey conducted by the ABS entitled Survey of Australian Outward Foreign Affiliates Trade.

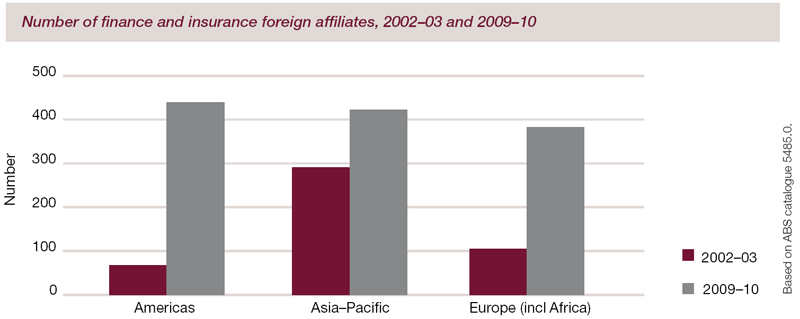

Growth in the number of finance and insurance foreign affiliates

The number of Australian finance and insurance foreign affiliates has grown dramatically, from 463 in 2002–03 to 1,245 in 2009–10.

While there was growth across all regions, it was especially strong in the Americas.

Key data: Australia's foreign affiliates 2009–10

- Thirty Australian companies had 1,245 finance and insurance foreign affiliates in 70 countries.

- Total Australian equity invested in these finance and insurance foreign affiliates was worth $71.1 billion in 2009–10.

- Australian finance and insurance affiliates abroad employed 75,919 people, paying wages and salaries of $6.7 billion. More than 40 per cent of these positions were at managerial or professional level.

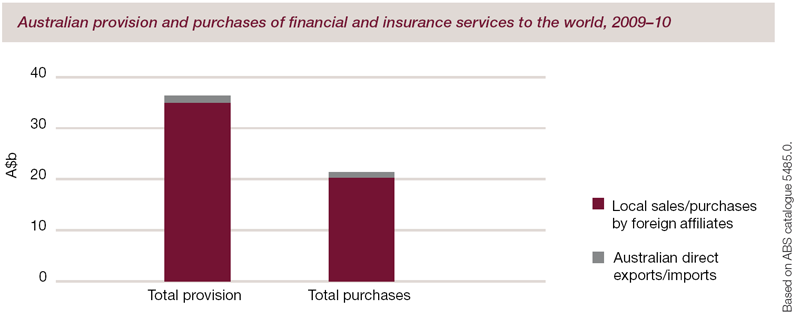

- The total economic value of financial and insurance services provided by Australia's foreign affiliates was $38.9 billion. Most of these sales – valued at $35.1 billion – were to the affiliates' host countries.

- Australian provision and purchases of financial and insurance services to the world, 2009–10

- The key markets for Australia's finance and insurance services provided by foreign affiliates were New Zealand, the United Kingdom, the United States, Hong Kong (SAR of China) and Singapore.

- The total economic value of financial and insurance services received by Australian foreign affiliates was $22.9 billion.

- Australian finance and insurance affiliates overseas made profits valued at $6.5 billion in 2009–10, a good result given the economic backdrop of the global financial crisis.

- A range of direct (explicit) financial services were provided by Australian finance and insurance affiliates in 2009–10, including credit granting services ($2.5 billion), portfolio management services ($1.4 billion), and deposit services ($0.7 billion), as well as a range of other financial services such as investment banking.

As China continues to urbanise and incomes rise, domestic consumption and services will play an increasingly vital role in the economy. This transition, strongly supported by government policy, creates enormous opportunities in China's domestic services market. The study found that Australian businesses have gained a foothold in the Chinese financial services market, with 14 Australian finance and insurance affiliates in 2009-10 located in China. The Australian Government is working to ensure that Australian financial institutions and their affiliates in China are well-placed to consolidate and expand in this rapidly-growing market.

Through Australia–China Free Trade Agreement negotiations, the Australian Government is pursuing high-quality commercial deals, with greater services and investment market access and a regulatory framework which encourages new investment and the sharing of expertise. The Government is supporting Australian banks, securities and funds management companies and insurance companies to identify and pursue opportunities for the expansion of two-way trade and investment. Australian financial institutions are taking advantage of the new prospects for business which are opening up in central and western China. They are also facilitating major deals between Chinese and Australian companies.

Through the negotiations, Australia hopes to continue to share best practice financial services standards with China, and see further mutually beneficial cooperation between regulators and financial institutions operating within these two markets.

Further information

Australian Bureau of Statistics, Australian Outward Finance and Insurance Foreign Affiliate Trade 2009–10, catalogue 5485.0, June 2011, at www.abs.gov.au.

Frank Bingham, 'Australia's Outward Finance and Insurance Foreign Affiliates Trade in Services, 2009–10', a DFAT analytical article at www.dfat.gov.au/publications/stats-pubs/trade_statistical_articles.htm.

For ongoing information on Australia's trade in services with the world, refer to the DFAT publication Trade in services Australia at www.dfat.gov.au/publications/statistics.html, which is published twice a year.