Uranium Exports and Production

| Item | Data |

|---|---|

| Total Australian UOC exports 2019–20 | 7,195 tonnes |

| Value Australian UOC exports | $688 million |

| Australian exports as percentage of world uranium requirements6 | 8.9% |

| Number of reactors (GWe) these exports could power7 | 35.6 |

| Power generated by these exports | 243 TWh |

| Expressed as percentage of total Australian electricity production8 | 92% |

Australia has around one third of the world's uranium resources, and remains the world's third ranking producer. There are currently three operating Australian uranium mines: Ranger in the Northern Territory, and Olympic Dam and Beverley Four Mile in South Australia. The Ranger uranium mine is scheduled to close in January 2021. In 2013, the Honeymoon uranium mine in South Australia was placed in care and maintenance, but has since been purchased by Boss Resources Limited, which has plans to restart and expand the operation.

Like most major global markets, the uranium industry has been impacted by the COVID–19 pandemic in 2020.

The Australian Government, alongside state and territory governments, announced wide-ranging measures in an effort to curb the virus.

Global production of uranium is likely to experience a decrease in 2019–2020. In April 2020, Kazakhstan's Kazatomprom announced that measures would be implemented for a three-month period to reduce the number of staff on mining sites and these measures were extended in July 2020.9

Additionally in April, Cameco announced similar temporary measures at its Port Hope Conversion Facility, the Blind River Refinery in Ontario and the Cigar Lake uranium mine in Saskatchewan. Production operations

resumed at Port Hope and Blind River in May, and Cameco announced plans to restart Cigar Lake in September 2020.10, 11

The Rossing uranium mine in Namibia also announced a suspension of normal mining operations in March 2020.12

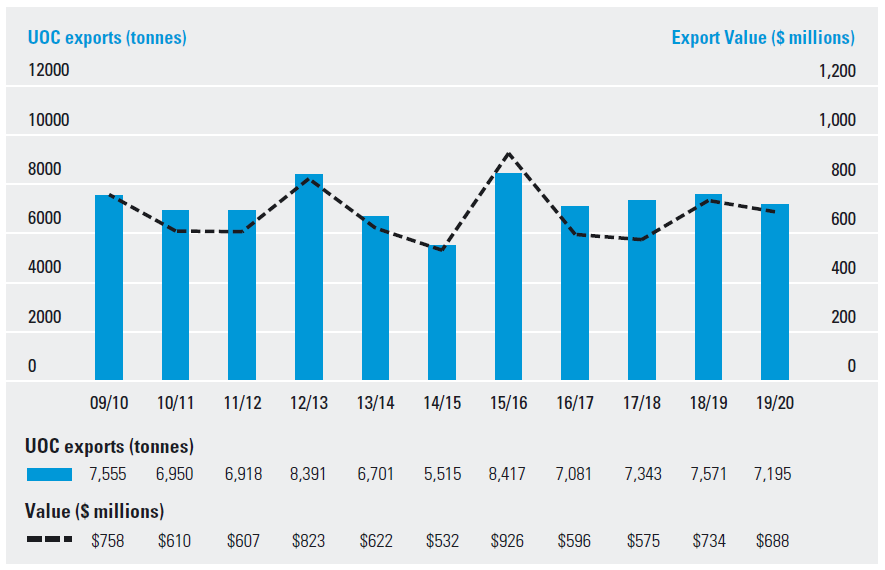

In 2019, the United States conducted an investigation into US imports of uranium, ultimately determining that uranium imports do not threaten US national security. Following on from the investigation, the United States Nuclear Fuel Working Group (NFWG) was established to develop recommendations for reviving and expanding the United States' domestic nuclear fuel production. The NFWG published a report entitled Restoring America's Competitive Nuclear Energy Advantage in April 2020.13 The report recommends that the US Government take action to ‘revive and strengthen the uranium mining industry, support uranium conversion services [and] end reliance on foreign uranium enrichment capabilities.' 14 In the 2019–20 period, Australia exported 7,195 tonnes of uranium ore concentrate (UOC) at a value of approximately $688 million (see Figure 1).

Figure 1: Quantity and value of Australian UOC (U3O8) exports from 2009/10 to 2019/20

Australia's Nuclear Safeguards Policy

The Australian Government's uranium policy limits the export of Australian uranium to countries that: are a party to the Treaty on the Non-Proliferation of Nuclear Weapons (NPT);15 have a Safeguards Agreement and Additional Protocol with the IAEA in force; and are within Australia's network of bilateral nuclear cooperation agreements. These nuclear cooperation agreements are designed to ensure IAEA safeguards and appropriate nuclear security measures are applied to AONM (Australian Obligated Nuclear Material) exported overseas, as well as a number of supplementary conditions. Nuclear material subject to the provisions of an Australian nuclear cooperation agreement is known as AONM. The obligations of Australia's agreements apply to uranium as it moves through the different stages of the nuclear fuel cycle, and to nuclear material generated through the use of that uranium.

All Australia's nuclear cooperation agreements contain treaty-level assurances that AONM will be used exclusively for peaceful purposes and will be covered by safeguards arrangements under each country's safeguards agreement with the IAEA. In the case of non-nuclear-weapon states, it is a minimum requirement that IAEA safeguards apply to all existing and future nuclear material and activities in that country. In the case of nuclear-weapon states, AONM must be covered by safeguards arrangements under that country's safeguards agreement with the IAEA, and is limited to use for civil (i.e. non-military) purposes.

The principal conditions for the use of AONM set out in Australia's nuclear cooperation agreements are:

- AONM will be used only for peaceful purposes and will not be diverted to military or explosive purposes (here military purpose includes: nuclear weapons; any nuclear explosive device; military nuclear reactors; military propulsion; depleted uranium munitions, and tritium production for nuclear weapons)

- IAEA safeguards will apply

- Australia's prior consent will be sought for transfers to third parties, enrichment to 20 per cent or more in the isotope 235U and reprocessing16

- Fall-back safeguards or contingency arrangements will apply if for any reason NPT or IAEA safeguards cease to apply in the country concerned

- internationally agreed standards of physical security will be applied to nuclear material in the country concerned

- detailed administrative arrangements will apply between ASNO and its counterpart organisation, setting out the procedures to apply in accounting for AONM

- regular consultations on the operation of the agreement will be undertaken and

- provision will be made for the removal of AONM in the event of a breach of the agreement.

Australia currently has 25 bilateral nuclear cooperation agreements in force, covering 43 countries plus Taiwan.17

Accounting for Australian Uranium

Australia's bilateral partners holding AONM are required to maintain detailed records of transactions involving AONM. In addition, counterpart organisations in bilateral partner countries are required to submit regular reports, consent requests, transfer and receipt documentation to ASNO.

ASNO accounts for AONM on the basis of information and knowledge including:

- reports from each bilateral partner

- shipping and transfer documentation

- calculations of process losses and nuclear consumption, and nuclear production

- knowledge of the fuel cycle in each country

- regular reconciliation and bilateral visits to counterparts

- regular liaison with counterpart organisations and with industry and

- IAEA safeguards activities and IAEA conclusions on each country.

Australia's Uranium Transhipment Security Policy

For States with which Australia does not have a bilateral nuclear cooperation agreement in force, but through which Australian uranium ore concentrates (UOC) are transhipped, there must be arrangements in place with such States to ensure the security of UOC during transhipment. If the State:

- is a party to the Convention on the Physical Protection of Nuclear Material (CPPNM)

- has a safeguards agreement and adopted the IAEA's Additional Protocol on strengthened safeguards

- and acts in accordance with these agreements;

then arrangements on appropriate security can be set out in an instrument with less than treaty status.18 Any such arrangement of this kind would be subject to risk assessment of port security. For States that do not meet the above requirements, treaty-level arrangements on appropriate security may instead be required.

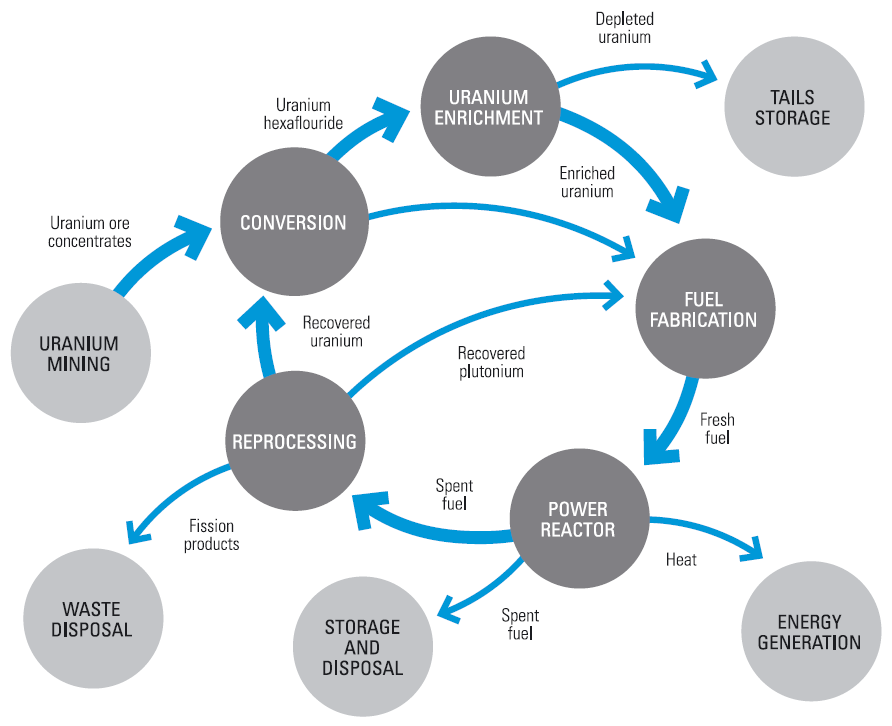

A characteristic of the nuclear fuel cycle is the international interdependence of facility operators and power utilities. It is unusual for a country to be entirely self-contained in the processing of uranium for civil use. Even in nuclear-weapon States, power utilities will often go to other countries seeking the most favourable terms for uranium processing and enrichment. It would not be unusual, for example, for a Japanese utility buying Australian uranium to have the uranium converted to uranium hexafluoride in Canada, enriched in France, fabricated into fuel in Japan and reprocessed in the United Kingdom.

The international flow of nuclear material means that nuclear materials are routinely mixed during processes such as conversion and enrichment, and as such cannot be separated by origin thereafter. Therefore, tracking of individual uranium atoms is impossible. Since nuclear material is fungible—that is, any given atom is the same as any other—a uranium exporter is able to ensure its exports do not contribute to military applications by applying safeguards obligations to the overall quantity of material it exports.

Figure 2: Civil Nuclear Fuel Cycle

This practice of tracking quantities rather than atoms has led to the establishment of universal conventions for the industry, known as the principles of equivalence and proportionality. The equivalence principle provides that where AONM loses its separate identity because of process characteristics (e.g. mixing), an equivalent quantity of that material is designated as AONM. These equivalent quantities may be derived by calculation, measurement or from operating plant parameters. The equivalence principle does not permit substitution by a lower quality material.

The proportionality principle provides that where AONM is mixed with other nuclear material and is then processed or irradiated, a corresponding proportion of the resulting material will be regarded as AONM.

6 Based on August 2020 world requirements of 68,240 tonnes U, from the World Nuclear Association's World Nuclear Power Reactors & Uranium Requirements.

7 Based on a comparison of GWe of nuclear electricity capacity and uranium required, for countries eligible to use AONM, from the World Nuclear Association's World Nuclear Power Reactors & Uranium Requirements, August 2020.

8 Based on Australia's electricity generation in calendar year of 2019 of 265.117 TWh from the Department of Industry, Science, Energy and Resources, 2019 Australian Energy Statistics, May 2020.

9 COVID-19: Update on Kazatomprom Operations, Kazatomprom, 6 July 2020.

10 Cameco Restarting Production at Ontario Operations, Cigar Lake Status Unchanged, Cameco, May 2020.

11 Cameco Reports Second Quarter Results, Well Positioned Financially, Supported by Cigar Lake Restart, Cameco, July 2020.

12 Rössing operations suspended in Namibian lockdown, World Nuclear News, March 2020.

13 Restoring America's Competitive Nuclear Energy Advantage, US Department of Energy.

14 Ibid.

15 On October 2012, the Australian Government announced that it would exempt India from its policy allowing supply of Australian uranium only to those States that are Parties to the NPT.

16 Australia has given reprocessing consent on a programmatic basis to EURATOM and Japan. Separated Australian-obligated plutonium is intended for blending with uranium into mixed oxide fuel (MOX) for further use for nuclear power generation.

17 Euratom is the Atomic Energy Agency of the European Union. The Australia-Euratom NCA covers all 27 Member States of the European Union, and the United Kingdom until the end of the transition period.

18 See page 26 of ASNO's 2008-09 Annual Report for more details on the establishment of this policy.